how to check unemployment tax refund amount

Alternatively you may call 518-457-5149. Using the IRS Wheres My Refund tool.

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

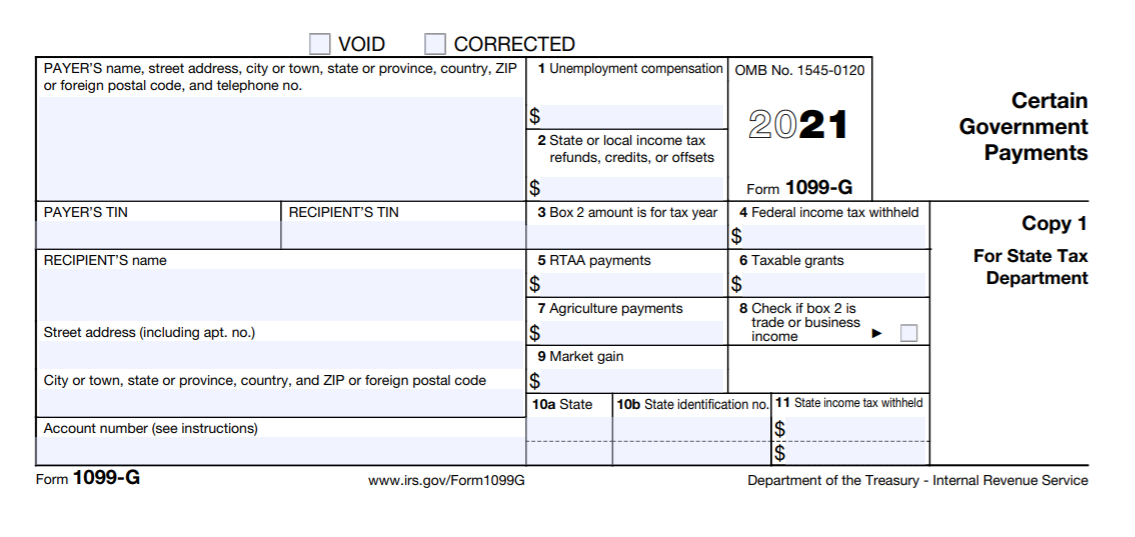

In Box 1 you will see the total amount of unemployment benefits you received.

. Block 38- Net Amount of Check Being Returned. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. And then the first refund check including interest for the delay in processing compare this with your tax return followed by the second refund.

The amount of tax to be withheld is determined using the approved withholding tables and methods and is based on the address and withholding allowances of the employee. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. Block 37- Refund Amount Less Deductions Refunded This figure is the amount of Block 36 subtracted from Block 18 Refund Amount.

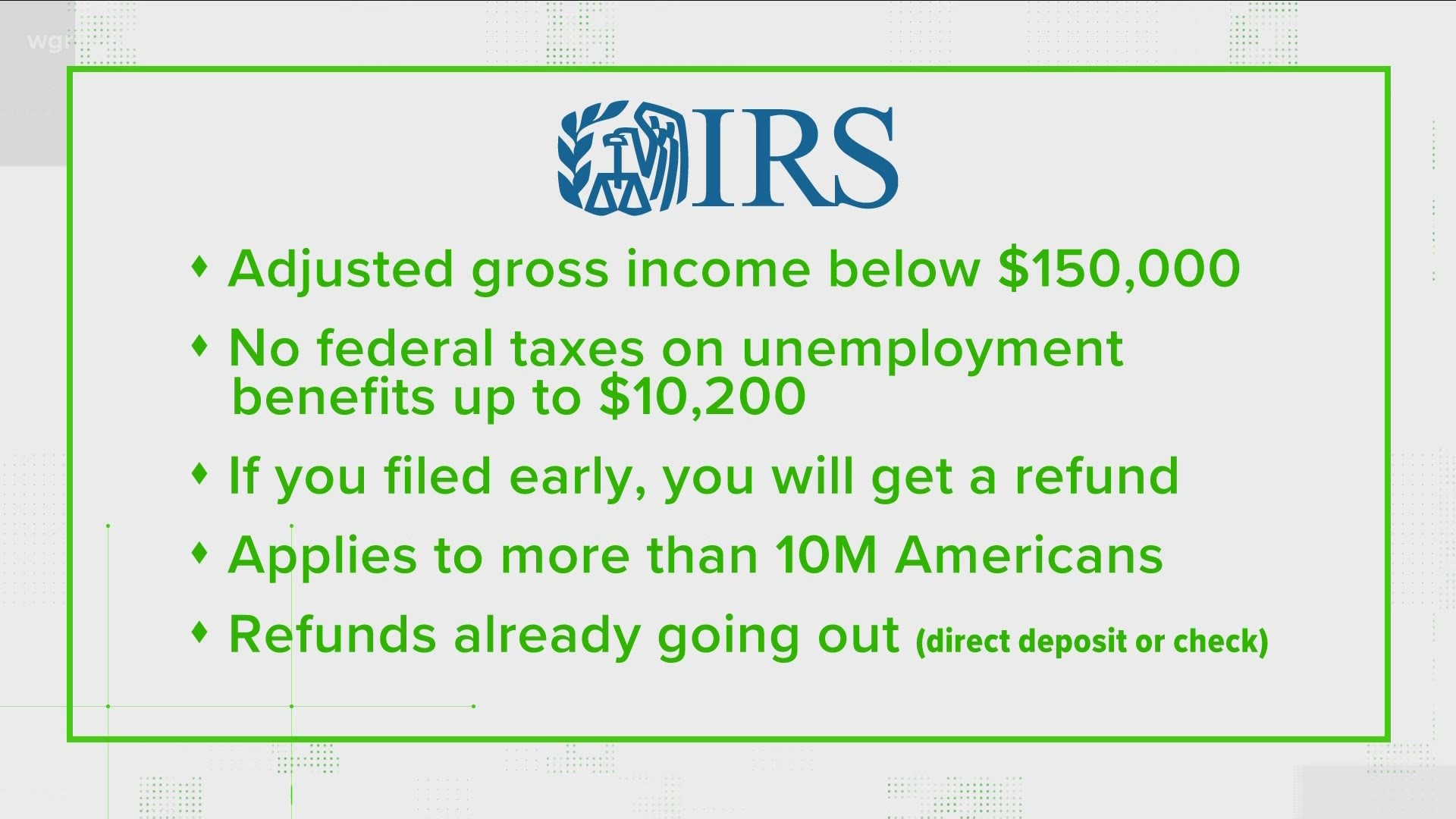

Income Tax Refund Information. If you are eligible for the extra refund for federal tax that was withheld from your unemployment the IRS will be sending you an additional refund sometime during the next. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189.

Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. If you received unemployment benefits in 2020 a tax refund may be on its way to you. This is the fourth round of refunds related to the unemployment compensation.

Check For the Latest Updates and Resources Throughout The Tax Season. Viewing your IRS account. The IRS has sent 87 million unemployment compensation refunds so far.

If you move without notifying. You will need the. Sign in to the Community or Sign in to TurboTax and start working on your taxes.

The quickest and easiest way to check on your New York state tax refund is to visit taxnygov and click on Check Your Refund link. The IRS is expected to continue working through the tax. The 310 code simply identifies the transaction as a refund from a filed tax return in the form of an electronic payment.

On Form 1099-G. After you file. In Box 4 you will see the amount of federal income tax that was withheld.

Viewing your tax records online is a quick way to determine if the IRS processed your refund. You can check the status of your current year refund online or by calling the automated line at 260-7701 or 1-800-218-8160.

Tax Deadline 2021 Irs Tax Refund Status Where Is It And How Do You Track Your Money With Irs Tools Marca

Irs Unemployment Refunds Moneyunder30

Update Irs Says No Amended Returns Needed For Federal Unemployment Tax Break

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Irs Sends First Unemployment Tax Refunds But Automatic State Refunds Are In Limbo Mlive Com

2 On Your Side Town Hall Verify Looks Into Refunds On The Unemployment Tax Rebate Wgrz Com

Your Unemployment Tax Refund Is Coming In May Irs Says Here S How To Get Yours Nj Com

Fox43 Finds Out How To Boost Your 2020 Tax Refund In Pa Fox43 Com

Update Irs Says No Amended Returns Needed For Federal Unemployment Tax Break

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status The Us Sun

Unemployment Benefits Tax Refund Will You Receive One Waters Hardy And Co P C

430 000 More Taxpayers Get Unemployment Related Tax Refunds Don T Mess With Taxes

Irs Unemployment Refund Update How To Track And Check Its State As Usa

Unemployment Tax Refund Update What Is Irs Treas 310 Kare11 Com

Irs Refund 4 Million Tax Refunds For Unemployment Compensation Marca

Kentucky Tax Filing Confused About Your 1099 Unemployment Form

How To Get A Refund For Taxes On Unemployment Benefits Solid State